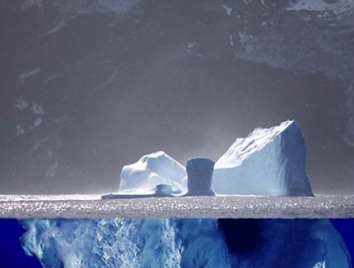

Tip of the Iceberg

From the forthcoming eBook ERP – Huge Mistake or Horrible Idea, Common Pitfalls of ERP Implementations the following synopsis examines outcomes based on over 300 ERP software evaluation/implementations ranging from 1999 – 2012.

Odds of Success

Depending upon who’s IT research numbers you source, (Aberdeen, Gartner, etc) somewhere between 78% – 86% of all ERP implementations result in failure when measured by cost, time to go-live or expected features and capabilities.

And these numbers-of-shame stretch across multiple software vendors, several industry verticals, and companies from very small to extremely large.

Yet when done right, ERP results can transform a company in dynamic ways, deliver phenomenal ROI, drive both cost savings and productivity increases.

Both successes and failures can happen regardless of the software platform or implementation team. From Sage resellers working with very small manufacturing firms all the way to Lawson M3 projects running in the millions, whether it’s Microsoft DynamicsNAV, Epicor or any one of a hundred – all have examples of tremendous success and horrid failures.

So what are the common elements of success? What are the pitfalls indicative of failure?

Over 300 different software evaluations were examined based on experience in both the sales process, implementation and ongoing support.

The most glaring commonality?

While failure rates run incredibly high, the approach to software evaluation is surprisingly uniform – regardless of the company, industry or staff. From the stock RFP downloaded from the internet to the days of demos scheduled, to using consultants who have little experience with ERP – again and again, software evaluations are the same dance, different tune.

Global multi-nationals with IT staff of 25+, regional sub assembly manufacturers with an IT staff of 2 – it doesn’t seem to matter. Companies spending $70K or several million on the project – they all seem to follow the same template.

The Selection Committee

It usually starts by gathering a committee of managers or other leaders, usually several departments are selected – often times, one or more of the committee participants have undergone an ERP conversion at a previous company. Not surprisingly, whatever ERP vendor was chosen previously is immediately discounted “We did an SAP conversion at my last company – I can tell you, I’ll never go through that again!” So the one program that anyone has any experience with is immediately tossed.

And truly, it’s not a level playing field. Vendors participate in dozens of evaluations all year long. Selection Committees will chose perhaps one or two ERP systems in the course of a career.

The most common pitfall is that the Selection Committee doesn’t know what an ERP system can do, what functionality is out there. And internally, business processes can go on for years – masking the deficiency or hiding the problem. For example, planning meetings involve several managers each day to coordinate purchasing, inventory, pre-assembly lines, sub assembly lines, finishing departments, shipping, sales, etc. That’s the way the company has been doing it for years – it seems like a perfectly normal way to do business. However, there are Advanced Planning and Scheduling modules which automate the process, replacing the daily 12 manager, 2.5 hour planning meeting with a single planner working half a day to accomplish the same thing.

If you don’t know such a thing as Advanced Planning and Scheduling exist, how do you know to ask the software vendors to demonstrate such a capability?

And today’s software is so feature rich, so full of bells and whistles, you can actually do multi-day demos of a single package and never see everything the software can do. Not to mention the boredom ratio of seeing endless demos from multiple vendors means they may show a key feature on day two sometime after lunch when the audience’s attention is less than rapt – and your Selection Committee may never make the leap between this new, neat, whizbang feature and how it might actually apply to your business.

Then we come to the cost. How much does it cost? What is our budget? What will we spend?

Very common approach. Very backward way of doing things. You end up with a budget based on, really, nothing. Unless your company has one of those magical balance sheets that values wishes and dreams as company assets.

Another story – 2001 – a growing multi level marketing candle company called in need of accounting software and they were firm, serious, solid that the budget couldn’t exceed $20K. We went to tour the business and found that they were employing 35 people in a call center to take orders. We showed them a small ERP package with a web-order entry module, converted 93% of the phone orders to web orders and the were able to re-deploy nearly 30 people from typing orders to actually manufacturing and shipping candles – they saved nearly $300K in labor annually and ended up spending $200K on the software – so the point is:

Don’t start with the price you’ll pay for software, start with the value of the problem(s) you’ll solve.

The deeper picture

Initially, the purchase price you’re looking at contains A) software licensing fees (usually by user or module) B) Consulting and Implementation fees (charged time and materials by the hour) and C) Annual Maintenance (normally 18% – 25% of initial purchase price).

And here’s another classic pitfall – Conventional Wisdom (CW) says we operate with three bids, three vendors to insure a fair price.

While this can be an accurate way to set your A) Software Licensing Fees – it means NOTHING when talking about B) Consulting and Implementation fees.

In many cases, the software publisher and the implementation team are from two different firms – ex: Microsoft writes and publishes Dynamics ERP – however, local reseller partners implement and support the software for the individual client companies. (Sage, Epicor and many others use this reseller model).

So let’s say you have three vendors delivering prices, all three competing for the business. A) Software Licensing Fees from all three are similar. But as you keep playing one vendor against another, the B) Consulting and Implementation Fees keep getting smaller. The rational is that you, the client company agree to take on more of the implementation tasks, thus lowering the number of hours in the Consulting and Implementation Bid. (Did we mention this is an Estimate?).

Also, there will generally be a Scope document, a Statement of Work (SOW) that carefully details what the consulting estimate will cover. (Later, this will serve to cover the vendors butt). So, you, the client company agree to take on more of the implementation. And you’ve done how many implementations? Usually zero or less.

What you don’t know

The software purchase price is only the tip of the iceberg. For every hour in a standard implementation bid, your staff will need to spend 3 hours. So if the vendor is proposing 400 consulting days, you’re going to need 1,200 man-days devoted solely to the project of implementing the ERP system.

Let’s say you’ve set a goal of go-live on the new project 6 months from today. And let’s assume there are 10 people on your Selection Committee that will work on your Project Team – remember you’re going to need input from purchasing and accounting, manufacturing, quality, warehouse, shipping – all play a role in the system. So what you’ve just committed to is everyone on the Project Team being away from their regular job duties for 3-6 weeks during the next 6 months.

To put that in perspective, imagine 10 of your key people taking a month to a month and a half off during the next 6 months – how productive is your company going to be?

The point is, it’s a massive undertaking – almost always underestimated by the company.

Secondly, as you realize what the true scope of the project really is, how time consuming it can be, the project begins to slip. Deadlines are missed. And it’s usually the company needing to push back.

So you come to the end of the 6 month estimated Consulting and Implementation Bid and the project is nowhere near go live. Yet at this point, you’ve sunk the A) License Fee, B) Consulting budget and C) Maintenance fees and it looks as if only another 25% will finish the project – plus – it’s not the vendors fault, we the company had to push back because we didn’t know how big this project was going to be.

So you spend another 25% – followed by well, just 15% more and then, it’s only reports and training, just 25% more – “oh look, we just went 30% over the original number the vendor originally estimated before we made them ‘sharpen their pencils’ and come back with a better price.”

See, once you’ve purchased the software – regardless of how much the consulting fees run over budget, it’s too late to switch back to another vendor.

Things to remember:

Resellers split sales revenues of the License Fee with the publishers, and then make 80% of their annual revenue on Consulting fees – and the Consultants annual bonus is based on how many hours he/she bills for the year.

It’s in their interest to stretch out the implementation.

As opposed to software publishers who install their product – their revenue is software driven – the more software they can sell, install and move to the next project, the higher annual revenues for the software firm.

Hey, I bought a Solution!

If you look at popular software sales training – it all focuses on ‘Solution Selling.’ This is a theory that vendor sales teams should operate as if selling a client company the software, it will be a ‘solution’ to all the companies’ problems.

Great. Nice. Wonderful.

Except that’s not how the successful ERP implementations operate.

Big Industry Secret #24 – The software you’re buying does nothing. That’s right. It just sits there.

Story – It’s always interesting to take a prospect to a company for a ‘site visit.’ Of course, as due diligence before buying the software, the prospect wants to see it ‘working’. Which seems perfectly sensible. Until you realize that software working is just people typing on a keyboard in front of a monitor. Not much action there. Nothing to really ‘see’. So I always try to set up the site visit just before lunch or happy hour – sitting down and talking to the users is the real value of the site visit, because, after all, the software itself does….nothing.

So why are you spending all this money on software that does nothing?

Because it’s your people, your staff that can do their jobs better using the software. So it’s not a ‘solution’. It’s a toolbox – and just like any other tool in the box, the more people use it, the better they get with it.

AND – the big AND – we’re talking about giving them tools to do the job better. Which in some cases means doing things differently – the 12 managers holding the daily manufacturing planning meeting we spoke of earlier – the meeting that was replaced by a planner using Advanced Planning and Scheduling – other things went on in that meeting that no longer occurs, communication and coordination that’s now not happening. So without going back to the old way of spending 60 management hours weekly on planning – is there a way we can meet briefly, quickly and still accomplish our communication and coordination – Oh, now we’ve added Change Management to the ERP Project – perhaps not in the first initial weeks of the project, but eventually it becomes the crux of the project ROI.

Avoiding the Iceberg

So, to summarize – there’s much of the ERP Iceberg we can’t see from our standard, uniform methodology of evaluating software.

We need someone who’s been under the surface and understands the pitfalls of the project, understands that it’s more than just the initial purchase price we’re getting ready to commit.

We need to start with a goal in mind, and set our project budget based on the ROI we’ve identified from the start, because we have to budget purchase price, realistic implementation estimates for consultants as well as our internal project team, factor in the change management and performance improvement we’ll need to realize our goals and then and only then do we set a course that has a better than industry average 14% – 22% chance of success.

Gene Hammons MBA can be reached at GH@GeneHammons.com.